Introduction

Investment-grade silver coins are a solid choice for those seeking financial stability and long-term wealth preservation. As tangible assets with intrinsic value, silver coins provide a hedge against inflation and economic uncertainty. This article highlights five of the best silver coins for investment, focusing on their silver content, global demand, and resale value. These coins are excellent options for preserving wealth and diversifying your investment portfolio.

1. American Silver Eagle

The American Silver Eagle is a staple in the world of silver investing. First introduced in 1986, this coin is highly regarded for its purity and backing by the U.S. government. Each coin contains one troy ounce of 99.9% pure silver, making it a reliable option for investors.

- Silver Content: 1 troy ounce of 99.9% pure silver

- Global Demand: High due to its recognition and liquidity

- Resale Value: Strong, with consistent premiums over the spot price

For more details on specifications and current pricing, visit SD Bullion and Monex.

2. Canadian Silver Maple Leaf

Known for its iconic maple leaf design, the Canadian Silver Maple Leaf is another popular choice for silver investors. Issued by the Royal Canadian Mint, it boasts a higher purity level than most other silver coins, at 99.99% pure silver.

- Silver Content: 1 troy ounce of 99.99% pure silver

- Global Demand: High, favored for its purity and quality

- Resale Value: High, often sold at a premium

For detailed specifications and current pricing, see APMEX and Monex.

3. Austrian Silver Philharmonic

The Austrian Silver Philharmonic coin is cherished for its silver content and design, which celebrates the Vienna Philharmonic Orchestra. Minted by the Austrian Mint, it is Europe’s most popular silver bullion coin.

- Silver Content: 1 troy ounce of 99.9% pure silver

- Global Demand: Strong, particularly in Europe

- Resale Value: Competitive, with a stable market

Explore detailed coin specifications and pricing at SD Bullion and Monex.

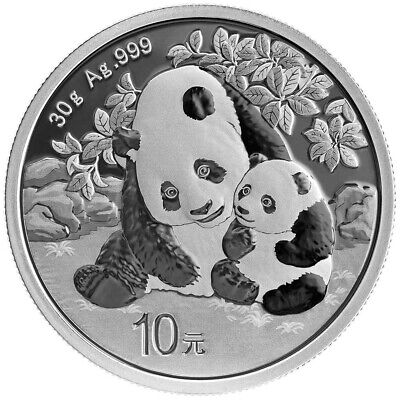

4. Chinese Silver Panda

The Chinese Silver Panda is unique due to its annually changing design, making it a favorite among collectors and investors. Issued by the People’s Republic of China, it is renowned for its craftsmanship and attention to detail.

- Silver Content: 30 grams of 99.9% pure silver (approximately 0.9645 troy ounces)

- Global Demand: High, partially due to its collectible nature

- Resale Value: Often higher due to collectible appeal

Visit SD Bullion and Monex for more information on specifications and market pricing.

5. British Silver Britannia

The British Silver Britannia coin is celebrated for its classic design and historical significance. Minted by the Royal Mint, it is a symbol of British heritage and is highly sought after by investors around the globe.

- Silver Content: 1 troy ounce of 99.9% pure silver

- Global Demand: Growing, with increasing popularity worldwide

- Resale Value: Solid, with premiums reflecting its cultural significance

Check out detailed specifications and pricing at BOLD Precious Metals and Monex.

Conclusion

Investing in silver coins is a prudent approach to safeguarding wealth and ensuring financial stability. The American Silver Eagle, Canadian Silver Maple Leaf, Austrian Silver Philharmonic, Chinese Silver Panda, and British Silver Britannia offer unique benefits and strong market demand. By understanding these coins’ characteristics and market potential, investors can make informed decisions that align with their financial goals. Explore the provided links for detailed specifications and pricing to find the best options for your investment portfolio.